Jury Finds the Defendant Guilty of 34 Counts of Falsifying Business Records

Manhattan District Attorney Alvin L. Bragg, Jr. today announced the all-count trial conviction of DONALD J. TRUMP, 77, for falsifying New York business records in order to conceal his illegal scheme to corrupt the 2016 election. TRUMP was convicted by a New York State Supreme Court jury of 34 counts of Falsifying Business Records in the First Degree. He is expected to be sentenced on July 11.

“Donald Trump is guilty of repeatedly and fraudulently falsifying business records in a scheme to conceal damaging information from American voters during the 2016 presidential election. Over the course of the past several weeks, a jury of 12 every day New Yorkers was presented with overwhelming evidence – including invoices, checks, bank statements, audio recordings, phone logs, text messages, and direct testimony from 22 witnesses – that proved beyond a reasonable doubt that Mr. Trump illegally falsified 34 New York business records. Mr. Trump went to illegal lengths to lie repeatedly in order to protect himself and his campaign. In Manhattan, we follow the facts without fear or favor and have a solemn responsibility to ensure equal justice under the law regardless of the background, wealth or power of the accused. The integrity of our judicial system depends on upholding that principle,” said District Attorney Alvin Bragg.

As proven at trial, TRUMP engaged in a scheme to corrupt the 2016 presidential election and went to extraordinary and illegal lengths to hide this conduct from the American voters and public, illegally causing dozens of false entries to be made in New York business records of his Manhattan-based company to conceal attempts to violate state election law.

The genesis of the scheme was a 2015 meeting at Trump Tower where an agreement was hatched between TRUMP, his former attorney Michael Cohen, and David Pecker, the CEO of American Media Inc. (“AMI”). TRUMP, David Pecker and Michael Cohen agreed that AMI would prevent damaging information about TRUMP from becoming public. AMI, which owned the National Enquirer, purchased stories as part of a “catch and kill” strategy in order to protect TRUMP.

In one instance, American Media Inc. paid $30,000 to a former Trump Tower doorman, who claimed to have a story about a child TRUMP had out of wedlock.

In a second instance, AMI paid $150,000 to a woman who alleged she had a sexual relationship with TRUMP.

In the weeks before the election, a video from the TV show Access Hollywood became public in which TRUMP was recorded on a hot mic saying in part, “You know, I’m automatically attracted to beautiful women, I just start kissing them, it’s like a magnet, just kiss, I don’t even wait, when you are a star they let you do it, you can do anything, grab them by the p****, you can do anything.”

The following day, the Editor-in-Chief of the National Enquirer informed Michael Cohen that the adult-film actress Stormy Daniels was planning to come forward about a sexual encounter she had with TRUMP.

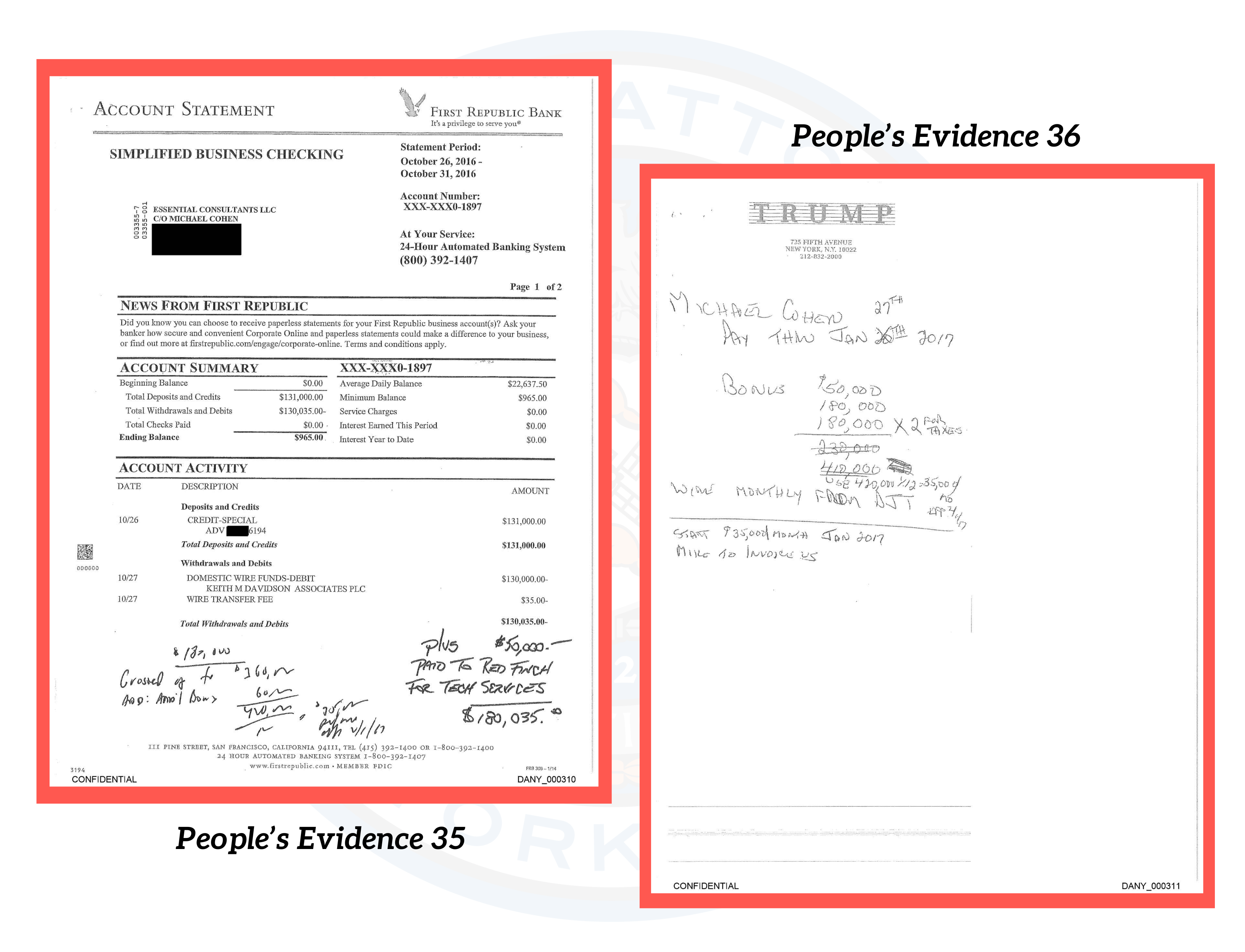

Cohen and TRUMP, knowing how devasting Daniels’ story would be to the campaign, agreed to buy her story to defraud the voting public and prevent them from learning the information before Election Day. Cohen, with the approval of TRUMP, set up a shell company called Essential Consultants, LLC and wired $130,000 to Keith Davidson, the attorney for Stormy Daniels. Cohen used false information and records to disguise the true nature of the shell company. Phone records shown at trial and testimony from witnesses proved that TRUMP was in the loop every step of the way.

After winning the election, TRUMP reimbursed Cohen through a series of monthly checks, first from the Donald J. Trump Revocable Trust – created in New York to hold the Trump Organization’s assets during TRUMP’s presidency – and later from TRUMP’s bank account. In total, 11 checks were issued for a phony purpose. Each check was processed by the Trump Organization and illegally disguised as a payment for legal services rendered pursuant to a non-existent retainer agreement. In total, 34 false entries were made in New York business records to conceal the initial covert $130,000 payment. Cohen was paid $420,000 in total so he would be made whole on the payment, which was being disguised as income and therefore would be taxed.

Assistant D.A.s Matthew Colangelo, Christopher Conroy, Katherine Ellis, Susan Hoffinger, Becky Mangold and Joshua Steinglass are handling the prosecution of this case, with the assistance of Steven Wu (Chief of the Appeals Division), Alan Gadlin (Deputy Chief of the Appeals Division) and Assistant D.A.’s Philip Tisne, John Hughes, and Caroline Williamson. Paralegals Georgia Longstreet, Jaden Jarmel-Schneider, and Nishant Bhaumik also provided assistance.

D.A. Bragg thanked the members of the NYPD and the Office of Court Administration for their professionalism and tireless efforts to maintain a safe environment throughout the duration of the trial.

Defendant Information:

DONALD J. TRUMP

Palm Beach, Florida

Convicted:

- Falsifying Business Records in the First Degree, a class E felony, 34 counts

###